One of the best ways to find when the price could be looking to move or continue lower is using bearish candlestick patterns.

Bearish candlestick patterns can quickly and easily help you identify market turning points or areas where the sellers could be gaining control.

In this post, we go through some of the most popular bearish candlestick patterns and how you can use them in your trading.

NOTE: You can get your bearish candlestick patterns PDF free guide below.

What is a Bearish Candlestick Pattern?

Bearish candlestick patterns are patterns you can use to identify when the price is looking to move lower.

These patterns can be as simple as a one candlestick pattern, or they could form over many.

The key with bearish candlestick patterns is where and how they form within the overall price action.

As we discuss in more depth below, the best patterns will form in critical areas that confirm a potential move lower.

How to Trade Bearish Candlestick Patterns

The two ways to use bearish candlestick patterns are;

- To find and enter short trades.

- Manage existing trades you have open.

When using bearish candlestick patterns to make new trades, you usually look at when the market could reverse lower. For example, if the price has been in a move or trend higher, you would be looking at specific patterns that hint the price will reverse lower.

When using bearish candlestick patterns to manage your open trades, you are looking to identify good spots to take profit or move your stop loss.

If you are in a long trade and you see a pattern that indicates the price may be about to move lower against you, you can use that information to take your profits or readjust your stop loss level.

Hanging Man Pattern

The hanging man is a pattern that forms after the price has been moving or trending higher.

This is a bearish reversal pattern and hints that the price could reverse and start falling lower.

The hanging man candlestick pattern is a one candlestick pattern.

As the chart shows below, this pattern is formed with a small to no upper candle wick, a small body, and a large lower wick.

The pattern shows the bulls may be running out of steam, and a lower move could be on the cards.

It is essential this pattern forms after a move higher because it is a reversal pattern.

Dark Cloud Cover

The dark cloud cover is another bearish reversal candlestick pattern.

This pattern typically forms after the price has been moving or trending higher.

The dark cloud cover pattern is a two-pattern candlestick pattern and hints that the sellers may be taking control of the price.

To identify this pattern, you will need to see the price first gap out higher above the previous candlestick.

Price then moves lower and significantly closes below the 50% mark of the previous candle.

Bearish Engulfing Bar

The bearish engulfing bar is one of the more powerful candlestick patterns. It is also straightforward to identify.

This pattern indicates that the sellers have taken control, and a move lower could be on the cards.

To be a bearish engulfing bar pattern, we need to see the engulfing bar fully ‘engulf’ the previous candlestick.

That means there should be a higher high and a lower low than the previous candle.

We also want to see the price close towards the bottom 1/3rd of the candle, showing us that the sellers were in control until the end of the session.

Shooting Star

The shooting star candlestick pattern trading strategy is a pattern that indicates a reversal lower could soon play out.

This pattern needs to form after seeing a move or trend higher.

You will need to see a large upper candle wick to identify the shooting start pattern. There should be a small body and little to no lower candlestick shadow.

The example below shows a shooting start pattern in play.

You will notice a large upper wick indicating that the bulls tried to push the price higher, but the bears jumped in and sent it back lower.

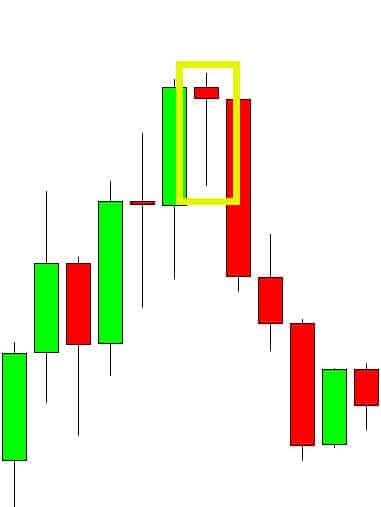

Evening Star Pattern

The evening star pattern is a pattern we can use to identify when a trend higher could be about to come to an end, and a new move lower is about to start.

This is a small candlestick pattern, and it does not form as often as some other candlestick patterns.

This is a multiple candlestick pattern. It is first formed when price makes a large bullish candlestick. Next, price forms a much smaller candle where price moves higher only slightly. The third candle then forms a large bearish candle showing the sellers are trying to take over.

The opposite to this pattern is the morning star pattern, which is a bullish candlestick pattern.

Three Black Crows

Another pattern that doesn’t form all that often but can be a powerful signal for a bearish reversal is the three black crows pattern.

This is a simple pattern to identify where we see three large bearish candlesticks in a row with little to no candlestick wicks on either end.

The three black crows pattern can be used to find new bearish trades or manage our open positions.

This pattern is best used with other indicators and price action analysis to confirm a move lower.

Lastly

While these are some of the most popular bearish candlestick patterns, they are often used with other strategies to increase their win rate.

An example would be using them with other popular indicators and technical analysis. For example, you may use an indicator such as the RSI to find when a market is overbought and then use one of these bearish candlestick patterns for your trade entry.

While you can use many bearish candlestick patterns, you don’t need to know them all.

Often the best way is to find the bearish candlestick patterns you like to trade the most and master them, rather than trying to remember and trade them all.

NOTE: You can get your bearish candlestick patterns PDF free guide below.

Stock Markets Guides content team.