Candlestick patterns are some of the most powerful trading techniques you can use in our trading. These patterns can help you find bullish and bearish trades, and they can also help you manage your open trades.

In this post, we’ll explore 35 powerful candlestick patterns you can start using in your trading today.

Note: You can get your 35 powerful candlestick patterns PDF and cheat sheet below.

What are Japanese Candlestick Patterns

Japanese candlestick patterns are price action formations you can use to predict where the future price may go.

They are called candlestick patterns because they are formed on candlestick charts and form a repeatable pattern.

Technical analysis and pattern traders look to these patterns because they believe they can show the times when the bulls or bears are in control. This can lead to high probability trades.

Most traders who use candlestick patterns look at these patterns as signals to buy or sell.

There are both bullish and bearish candlestick patterns, and in this post, we go through both types and how you can use them.

How to Trade With Candlestick Patterns

Most traders use candlestick patterns as entry signals. You can, however, also use them to manage your open trades, including using them for take-profit targets and stop-loss points.

One thing that is often overlooked by retail traders when trading candlestick patterns is where they form and in what context is critical.

To find the best trades using these patterns, you will want to look at things like whether the market is trending or ranging or if there are critical levels of support and resistance.

If you are after the best results, you will want to use other information to help you find the best trades and not use candlesticks alone.

An example of this would be using popular indicators such as moving averages or the MACD. Using other indicators and price action analysis will help you confirm high-probability trades and increase your chance of winning trades.

Note: You can get your 35 powerful candlestick patterns PDF and cheat sheet below.

List of 35 Powerful Candlesticks Patterns

Here is your complete list of 35 powerful candlestick patterns you can start using in your trading now. You can also get the free PDF of the 35 powerful candlestick patterns below.

1. Hammer

The hammer pattern is a single candlestick formation that signals a potential reversal back higher.

The key to the hammer is that it needs to form at the end of a move or trend lower.

The example below shows a bullish hammer pattern in play.

We can see that price opened and sold off heavily; however, by the end of the session, the bulls had roared back and taken over, signaling they were looking to price back higher.

2. Bullish Engulfing Bar

The bullish engulfing bar is a high probability pattern that hints that a reversal back lower is about to take place.

This candlestick pattern forms when the engulfing bar completely engulfs the previous candle.

For a valid bullish engulfing bar, there needs to be a lower low and higher high than the previous candlestick.

This indicates that the bulls have taken complete control, and the price could be looking to make a new move higher.

Check out an example of a valid bullish engulfing bar below.

3. Piercing Pattern

The piercing pattern is a pattern formed with multiple candlesticks.

This pattern is a bullish reversal pattern that needs to form after a move or trend is lower.

The first candlestick of this pattern is a significant bearish candlestick with little to no wicks.

The second candlestick then gaps lower than the previous candle, but the buyers come in, and the candle finishes above the mid-way point of the first candle.

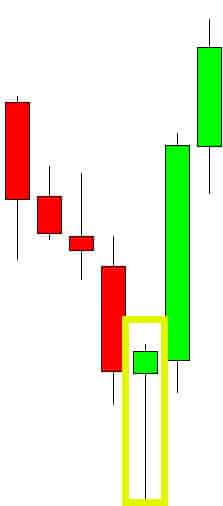

4. The Morning Star

The morning star pattern is formed with three candlesticks.

This is a bullish reversal candlestick pattern, and it should form after a move lower.

The first candlestick of this pattern is a large bearish candlestick.

The second candlestick is a doji that shows indecision after the move is lower.

The final candlestick is a significant bullish candlestick showing the buyers have now taken control after the indecision of the doji candlestick.

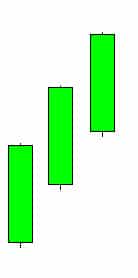

5. Three White Soldiers

The three white soldiers’ pattern is a bullish candlestick formation that hints at a new move higher.

This pattern is formed when we see three consecutive bullish candlesticks that have little to no wick and open within the body of the previous candlestick.

See the example below of the three white soldiers’ pattern.

6. Three Inside Up

The three inside up candlestick pattern is a pattern that is formed with three candlesticks.

This is a bullish reversal candlestick pattern, and it should form after a move lower.

The first candlestick of this pattern is a large bearish candlestick.

The second candlestick is a small bullish candlestick that is entirely formed inside the first candlestick.

The last candlestick confirms the bullish reversal by moving and closing above the first candlestick.

Traders using this pattern will typically take a long position after it has confirmed itself, with the last candlestick closing higher.

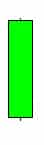

7. White Marubozu

The white Marubozu pattern is a single candlestick pattern that hints at a bullish reverse back higher.

This pattern has a long bullish body with little to no wicks on either side of the candle.

This shows us that the bulls have taken over and were in control for the whole session.

See an example of this pattern below.

8. Bullish Harami

The bullish harami pattern is another multiple candlestick pattern that hints at a reversal higher.

The first candlestick of the harami pattern is a large bearish candlestick with a large body and little to no wicks on either end.

The second candlestick is a small bullish candlestick that forms entirely within the previous candlestick.

This pattern should not be traded alone but with other market information such as the trend and critical support and resistance levels.

9. Inverted Hammer

The inverted hammer pattern is a bullish reversal candlestick pattern.

This pattern must form at the end of a move or trend lower.

To identify this pattern, we need to see that the opening and closing prices are close to each other and that there is a large wick that points higher.

See the example below of an inverted hammer pattern.

10. Tweezer Bottom

The tweezer bottom candlestick pattern is a bullish reversal candlestick that forms at the bottom of a move lower.

These two candlestick patterns show the bulls looking to take control and push the price back higher.

The first candlestick of this pattern is bearish, and the second a bullish candlestick.

The low of these candlesticks will be almost the same, showing that both candlesticks found support.

The patterns form more often than others and can be used on all time frames.

11. Three Outside Up

The three outside up is another bullish candlestick pattern that hints at a reversal back higher.

This pattern consists of three candlesticks, usually formed after a lower move.

The first candlestick is a small bearish candlestick.

The second candlestick in this pattern is a large bullish candle, and the third is another long bullish candle that confirms that the buyers have taken control.

12. Bullish Counterattack

The bullish counterattack pattern is a two candlestick pattern that indicates a potential bullish reversal.

This pattern will form after a move lower, and you can use it to try and ride the subsequent move back higher.

The first candlestick of this pattern is a long bearish candlestick with a large candle body.

The second candlestick is a significant bullish candlestick that closes at or near the first candlestick’s high.

This pattern shows that the bulls have moved into the market and are looking to push prices back higher.

13. On-Neck Pattern

The on-neck pattern is a bearish continuation pattern formed with two candlesticks.

This pattern hints that the move lower could be looking to continue.

The first candle of this pattern is a long bearish candlestick.

The second candle is a small bullish candle that gaps below the first candle and then closes close to where the first candle closed. This forms a horizontal neckline pattern.

14. Dark Cloud Cover

The dark cloud cover is a bearish reversal pattern that forms after the price has been moving higher.

This is a multiple candlestick pattern that shows the price may be moving from being bullish to bearish.

The first candlestick is a significant bullish candlestick which shows the price continuing on with the trend higher.

The second candlestick is a bearish candlestick that gaps above the first candle and then closes below the 50% mark of the first candlestick.

Traders will typically enter a short trade at the completion of this pattern and when the new candlestick opens.

15. Hanging Man

The hanging man pattern is a pattern that hints at a potential bearish reversal back lower.

This pattern must form after a move or trend higher because we are looking for a reversal lower.

To correctly identify this pattern, you want to see that the candlestick’s body is formed towards the top and that there is a long lower candlestick with little to no upper wick.

See an example below of a hanging man pattern.

16. Bearish Engulfing Bar

The bearish, engulfing bar pattern is the same as the bullish but inverse.

This pattern hints that there could be a bearish reversal and move lower on the cards.

To identify a valid bearish engulfing bar pattern, we need to see a higher high and lower low than the previous candlesticks.

We also want to see that the price has closed towards the bottom of the candlestick showing the sellers were in control when the candlestick finished forming.

This shows the bears have taken full control and are looking to push prices lower.

See an example of a bearish engulfing bar below.

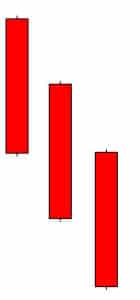

17. Three Black Crows

The three black crows pattern is similar to the three white soldiers’ pattern; however, this is a bearish pattern.

This pattern hints that the sellers are in control, and the price could move lower.

To identify the three black crows pattern, we want to see three consecutive bearish candlesticks with little or no candlestick wicks. We also want to see the candles form within the previous candlestick’s body.

See an example below of the three black crows’ pattern.

18. Black Marubozu

The black Marubozu pattern is the bearish opposite of the white Marubozu pattern.

This is a single candlestick pattern that indicates there could be a bearish reversal about to take place.

This pattern will form after a move or trend higher.

This pattern forms with one sizeable bearish candle with little to no wicks on either end of the candlestick.

The black Marubozu pattern shows that the sellers stepped in and controlled the selling for most of the session.

19. The Evening Star

The evening start pattern is another bearish reversal pattern that indicates a move higher could be coming to an end, and a new move lower is about to start.

This pattern is formed with three candlesticks.

The first candlestick is a bullish candle. The second is a doji that shows indecision in the market. The third is then a bearish candlestick.

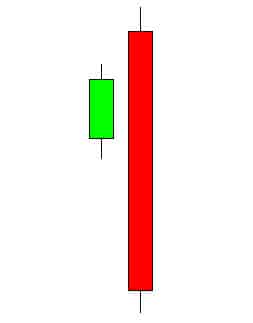

20. Three Inside Down

The three inside down pattern is a multiple candlestick pattern that hints at a bearish reversal.

This pattern typically forms after a move higher, and traders will generally enter a trade using this pattern to ride a move lower.

The first candle of this pattern is a long bullish pattern. The second is a small bearish candle, and the third is a large bearish candlestick confirming that patten.

Traders will typically enter a short trade once this pattern has been confirmed and the new candle opens.

21. Shooting Star

The shooting star is a bearish reversal signal hinting that the price may be about to move back lower.

The key with this pattern is that we need to see it formed after a move or trend higher.

The body of this pattern needs to form towards the lower of the candlestick, and we need to see a sizeable upper candlestick wick.

See an example below of a shooting star pattern.

22. Bearish Harami

The bearish harami pattern is the inverse of the bullish harami pattern.

This pattern is a bearish reversal pattern that hints that the bullish move higher could be coming to a close.

The first candlestick of this pattern is a large bullish candle, and the second is a small bearish candle that forms within the previous candles open and close.

Traders will typically enter a short trade when this pattern has been confirmed, and the new candle opens.

23. Tweezer Top

The tweezer top pattern is the inverse pattern of the tweezer bottom and indicates a potential reversal lower.

This pattern typically forms after a move higher, and traders will often use it to enter new short trades.

This pattern is formed with two candlesticks. The first candlestick is bullish, and the second is a bearish candlestick.

The key to this pattern is that both candlesticks have almost the same high. This shows resistance was found, and with the second candlestick, the bears took over and pushed the price lower.

24. Bearish Counterattack

The bearish counterattack is the inverse of the bullish counterattack.

This is a bearish reversal pattern and hints that the price could soon be looking to sell off and move lower.

This pattern will typically form after a move, or trend higher has taken place.

The first candlestick of this pattern is a large bullish candle with little to no wicks.

The second candle of this pattern then gaps higher but ends up closing lower and near the first candles closing price.

25. Doji

The Doji candlestick pattern is a pattern that shows you there is indecision in the markets.

The Doji is formed after the bulls and the bears have fought for where the price is to go, but the price ends up closing near the middle of the candlestick.

With this pattern, you will see higher and lower candlestick wicks with a small candlestick body.

See an example of a Doji candlestick pattern below.

26. Three Outside Down

The three outside down pattern is a bearish reversal pattern usually found after a strong move higher.

This pattern is formed with three candlesticks.

The first candle is a short bullish candle. The second is a large bearish candle that fully engulfs the previous candlestick. The third candle is another bearish candlestick that closes below the second candle.

Traders will typically enter a short trade when this pattern has been confirmed, and a new candle opens.

27. Spinning Top

The spinning top and the doji candlestick patterns are very similar.

These candlestick patterns have upper and lower wicks, but the spinning top pattern has a slightly larger candlestick body.

The spinning top indicates indecision in the market and buyers and sellers fighting for control.

See an example of a spinning top candlestick pattern below.

28. Falling Three Methods

The falling three methods pattern is a continuation pattern that signals a continuation of the trend lower could be in place.

This is a five candlestick pattern that shows there was a pause or disruption in the trend lower, but it could be about to continue.

This pattern is created with two large candlesticks in the same direction of the trend. There are then three smaller bullish candles in the middle.

This pattern shows that the bulls tried to push prices higher, but they could not gather enough steam to create a reversal back higher.

29. High Wave

The high wave pattern shows that the current price is indecisive and that neither the bulls nor the bears are in control.

This pattern typically forms in areas of important support or resistance.

The high wave pattern has very long upper and lower candlestick wicks and a small candle body.

This shows that both the bulls and the bears had periods of control during the session, but in the end, neither was in control.

30. Rising Three Methods

The rising three method pattern is the inverse of the falling three method pattern.

This pattern shows that a trend higher was interrupted, but it is likely to continue.

The rising three methods have two large bullish candlesticks and three small bearish candlesticks in the middle.

This shows that the bears tried to gain control and force a reversal lower but could not gather enough momentum to beat the trend higher.

31. Downside Tasuki Gap

The downside Tasuki gap pattern is a bearish continuation pattern that shows the trend lower could be looking to continue.

This pattern is formed with three candles. The first of these is a large bearish candlestick. The second is another sizeable bearish candle that gapped down. The third candlestick is a bullish candle that closes that last gap created.

This pattern is formed within a trend lower, and you can use it to identify when the price could be looking to continue moving lower.

32. Mat Hold

The mat hold pattern is a continuation pattern, indicating that a trend higher or lower is looking to continue.

There are both bullish and bearish mat hold patterns, and they can be very good at helping you manage your open trades.

A bullish mat hold pattern is created with five candles.

The first candlestick is a large bullish candle. The second candlestick then gaps higher. Three smaller bearish candlesticks then follow this.

33. Upside Tasuki Gap

The upside Tasuki gap is the inverse of the downside Tasuki gap pattern.

This pattern is formed with three candlesticks and indicates a continuation of the trend higher could be on the cards.

The first candlestick of this pattern is a large bullish candle. The second is another bullish candle that gaps above the first candle.

The third candlestick is a bearish candlestick that closes the gap created by the first two candles.

You can use this pattern to identify when the price could be looking to continue the trend higher.

34. Rising Window

The rising window pattern is a continuation pattern indicating that the price could be looking to carry on with the trend higher.

This pattern is formed with two candlesticks. Both candlesticks are strong bullish candles, with the second candle bursting out higher and creating a gap between the first candle.

You can use this pattern to identify when the price could be looking to continue a bullish trend.

35. Falling Window

The falling window pattern is the inverse of the falling window pattern.

This pattern indicates that the price could be looking to continue a move or trend lower.

The falling window pattern is formed with two bearish candlesticks. The second of these candle gaps lower before the first, showing the sellers are still in control.

You can use this pattern to identify when an existing trend lower could be looking to continue.

Note: You can get your 35 powerful candlestick patterns PDF and cheat sheet below.

Lastly

These 35 powerful candlestick patterns are just the start — there are many profitable patterns you can use in your trading.

The great thing about candlestick patterns is that they work over an extensive range of markets and can be used in many different time frames.

The key to these patterns is the market’s price action context and where they form.

The other thing to remember is that you don’t need to know all these patterns. You only need a handful of your favorites that you can master to make profitable trades.

Stock Markets Guides content team.

1 thought on “35 Powerful Candlestick Patterns PDF Free Guide Download”

Comments are closed.