The famous trader Bill Williams was one of the first traders to explore market psychology and trend following. He also created some of the most popular indicators still used to this day.

One of these indicators is the Alligator indicator.

In this post, we go through the alligator indicator and how you can use it in your trading.

NOTE: You can get your free alligator indicator trading strategy PDF below.

What is the Alligator Indicator?

The creator of this indicator, Bill Williams, believed that markets trend for only 15% – 30% of the time. He also thought the markets spend far more time trading sideways and in range patterns.

He found this information so important because the bulk of major traders’ profits are made when markets are trending strongly, either higher or lower.

Armed with this information, he created the Alligator indicator.

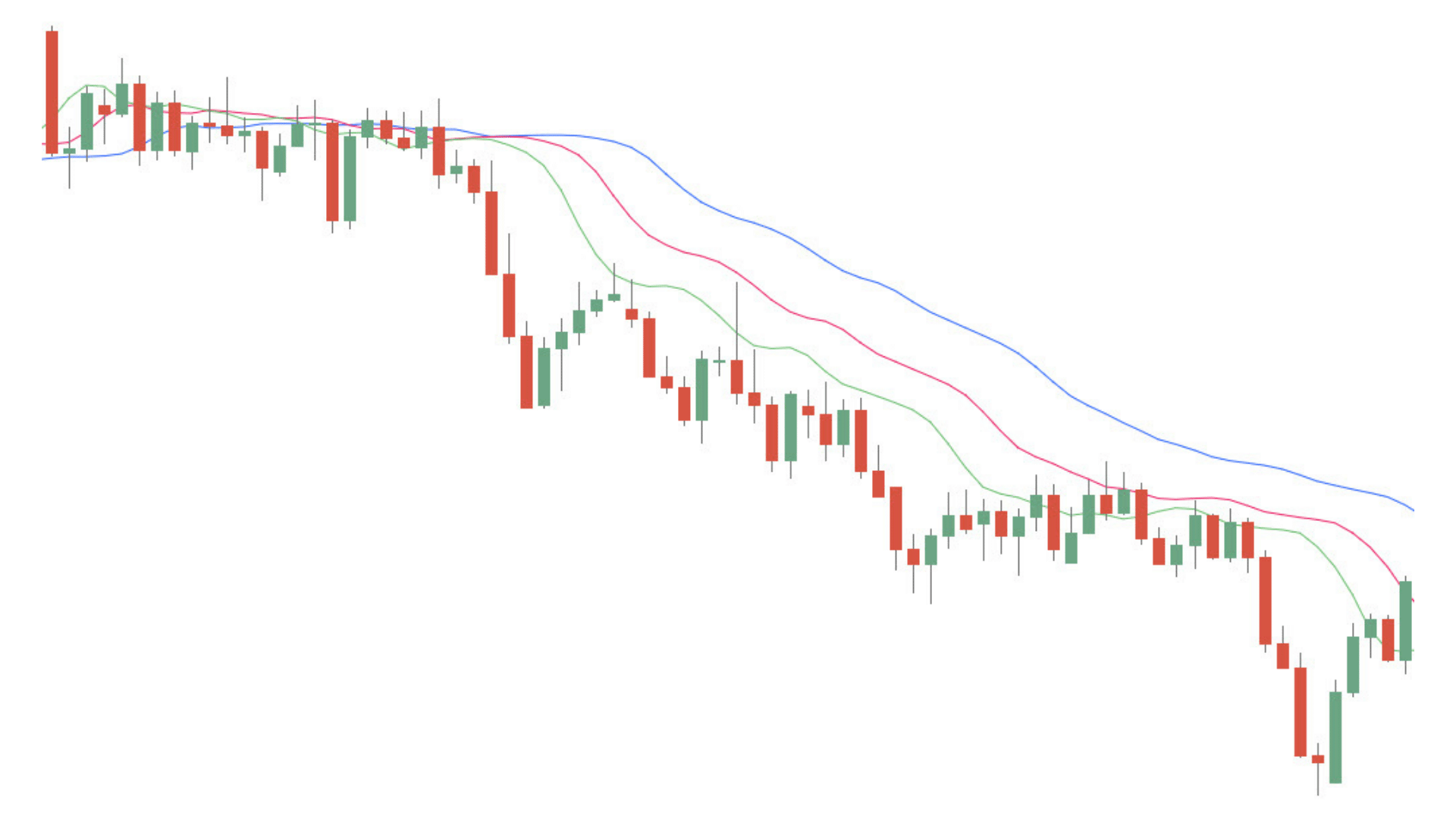

The alligator was designed to show when the price is in a trend or a sideways range pattern. It does this by using three moving averages that cross over each other.

These three moving averages are known as the alligator’s jaw, teeth, and lips. As we discuss in this post, the alligator’s jaw, teeth, and lips can help you find and manage your trades.

Alligator Indicator Settings

The Alligator indicator is created with three moving averages. These are simple moving averages set to five, eight, and 13 periods.

These three moving averages created the jaw, lips, and teeth to create the alligator.

- Jaw – Blue Line: This is a 13 period SMA and is smoothed by eight bars on subsequent values.

- Teeth – Red Line: This is an eight-period SMA and is smoothed by five bars on subsequent values.

- Lips – Green Line: This is a five-period SMA and is smoothed by three bars on subsequent values.

Once the alligator indicator is added to your chart, you will start to see these moving averages and how they either come together or begin to widen depending on if the price is trending or in a range.

How You Use the Alligator Indicator

When you have the alligator indicator on your chart, you will start to see how the jaw, lips, and teeth work together. You can use this information to find new trades and manage your existing trades.

The most common way the alligator indicator is used is to identify whether the price is in a range or a trend. You can also use it to see just how strong a trend is, either higher lower.

As the example chart shows below, the jaw, lips, and teeth are constantly moving in line with the price action.

When the moving averages are close together or intertwined, it is thought that the alligator is asleep. This usually is when the price is in a range period. This usually is when you would avoid taking new positions with this indicator.

After the alligator wakes from sleep, it starts to hunt for new bulls or bears to feed on.

When the moving averages start to move in one direction, either higher or lower, and the moving averages begin to widen, the alligator is awake and feeding. This is also when new trends are playing out.

When the moving averages start to move back closer together, it is thought the alligator is full and has stopped eating. This is often when you could look to close any existing trades until the alligator wakes up again.

Examples of Trading With the Alligator Indicator

As discussed, the easiest way to trade the alligator indicator is to closely watch what the alligator is doing and whether it is feeding or sleeping.

When the lines move closer together or start intertwining, it is often an excellent time to close out any open trades. This is also when you would be watching rather than opening new positions.

As the alligator lines move distinctly higher or lower, you could start looking for new trades.

In the chart example below, the alligator sleeps when the three moving averages come close together and start moving sideways.

Straight after this sideways movement, the alligator wakes up, and the indicator starts moving higher. This would be when you begin to look for long trades.

When the alligator lines start to cross back lower, you could take any profits you made from the move higher.

Alligator Indicator Combinations

The best combinations you can use with the alligator indicator include some of the most simple.

These include using other technical analysis and chart patterns.

For example, if you see the alligator start to trend higher, you could find long trades. You could do this by using other chart patterns and technical information. You could use these chart patterns to confirm long trades for higher probability entries.

You could also use other indicators with the alligator. These include the MACD, RSI, or any of your other favorite indicators.

Lastly

While the alligator indicator is a super simple indicator to use, it is essential you test it first in your trading.

Like any new indicator, the best thing you can do is test it in free demo charts using virtual money.

NOTE: You can get the best free charts and broker for these strategies here.

Once you are comfortable and happy with how it works, you could then incorporate it into your live trading. Doing this will ensure you don’t make any rookie mistakes with the indicator and that you are ready to use it with your other strategies.

NOTE: You can get your free alligator indicator trading strategy PDF below.

Stock Markets Guides content team.